|

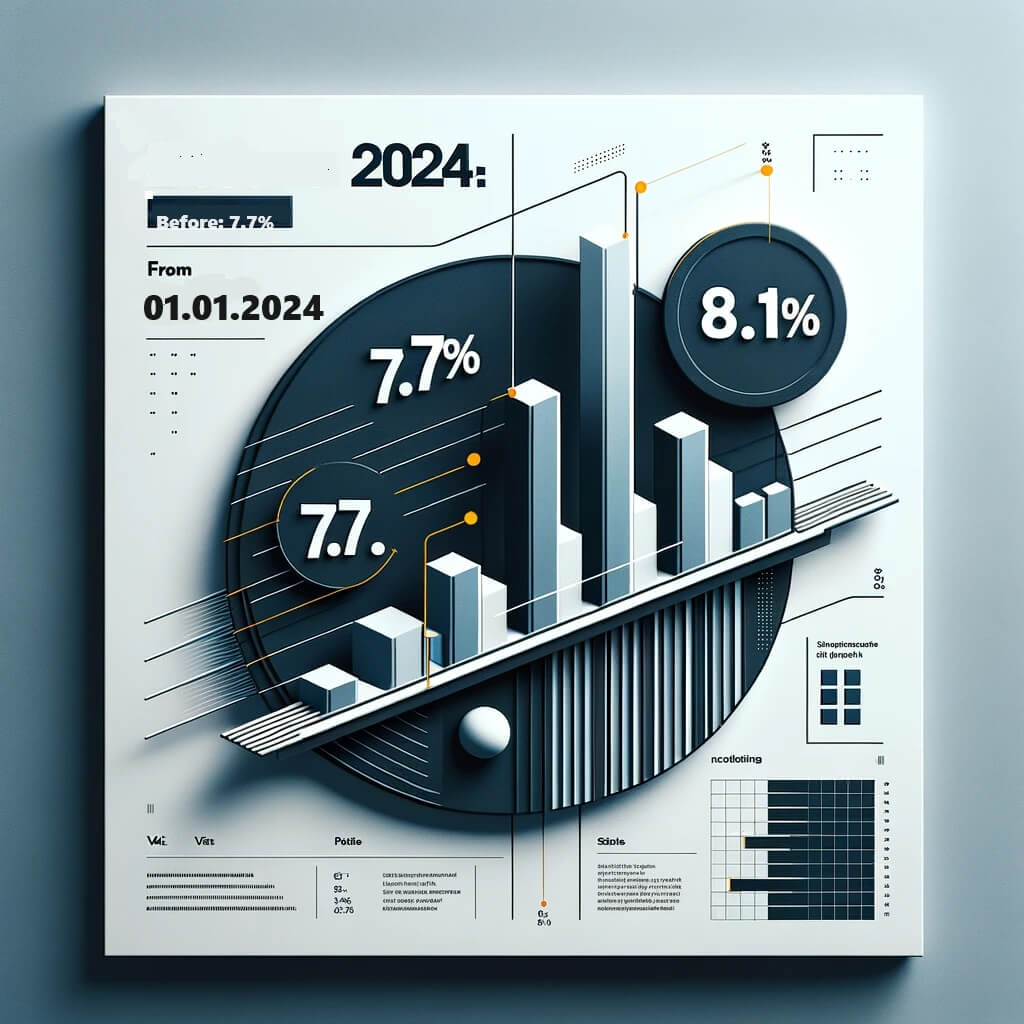

Value Added Tax (VAT) Increase as of January 1, 2024 |

1 Initial Situation

The VAT rates will be increased from 7.7% to 8.1% as of January 1, 2024, as well as the reduced VAT rates.

What Impact Do the Changes Have on the Billing of Services and Deliveries

First, the most important thing.

All valid VAT rates in Switzerland will be increased as of January 1, 2024. The table provides an overview:

| Until Dezember 31th 2023 | New form January First 2024 | |

| Standard Rate: | 7.7% | 8.1% |

| Reduced Rate: | 2.5% | 2.6% |

| Special Rate for Accommodation: | 3.7% | 3.8% |

lat Taxation (Flat Tax Rates)" or "Lump Sum Taxation (Lump Sum Tax Rates)

| Balance and Flat Tax Rates until December 31, 2023 | Balance and Flat Tax Rates from January 1, 2024 onwards |

| 0.1% | 0.1% |

| 0.6% | 0.6% |

| 1.2% | 1.3% |

| 2.0% | 2.1% |

| 2.8% | 3.0% |

| 3.5% | 3.7% |

| 4.3% | 4.5% |

| 5.1% | 5.3% |

| 5.9% | 6.2% |

| 6.5% | 6.8% |

2 Adjustments to VAT in all Invoices.

Accounts Receivable Software

Starting from January 1, 2024, it is essential to consider the new value-added tax (VAT) rate for all invoices. If you are using software such as AbaNinja or Bexio, the new VAT rates must be updated either by the software provider or entered manually.In the case of AbaNinja's free mode, which allows up to 2100 invoices per year, automatic adjustments for advance invoices cannot be made globally. Each one must be manually adjusted. If you are using a paid version (approximately $25/month), the software can handle this automatically.

Cash Register Systems

The same applies to all cash register systems, including electronic cash registers, Shopify point-of-sale systems, and similar systems.In many cases, you may need to engage the manufacturer to make these adjustments.

Please ensure that you update the new VAT rates in your systems to avoid any issues. If you have questions or need assistance, we are here to help.